<!–

–>

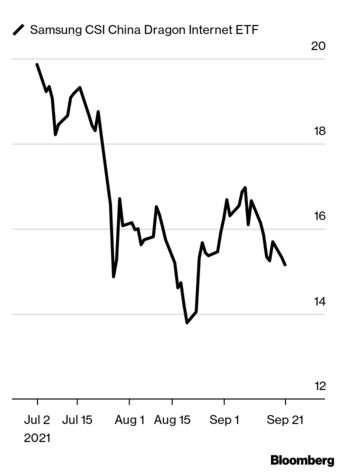

When it comes to China’s technology sector, in the last 12 months the market has gone from excessively optimistic to excessively pessimistic. When stocks correct so much, there is a favorable risk-reward calculation as you are getting in at the lower end of five-year average values.

Growth rates are going to slow down as companies like Meituan pay more in terms of social obligations to their drivers, yet those costs can eventually be passed on to the end consumer. It’s a similar story with Alibaba. While we’ve seen e-commerce penetration plateauing, if you believe in the Chinese consumption story the stock is attractive, particularly at a single-digit multiple.

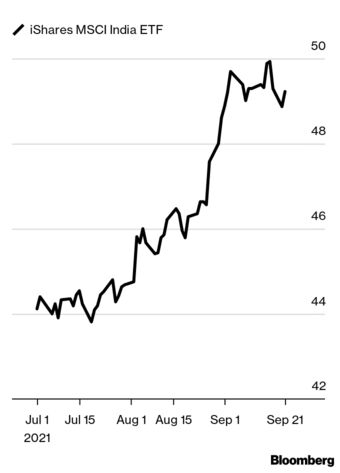

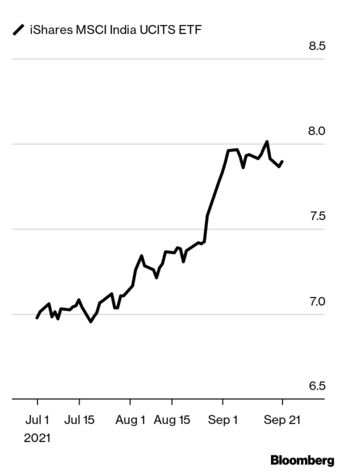

India is also promising. Prime Minister Narendra Modi has improved the climate for investing in the country, with reduced tax rates and production incentives. After Covid dislocations, most companies are now looking at a China-plus one strategy for suppliers as they’ve realized having 60 to 80% of products sourced from China is not something that can happen for the next decade.

Despite the big loss in terms of life that Covid took in India, the economy is rebounding well. We are positioned for a cyclical recovery and own things like banks and industrials. Part of our evergreen exposure is on the consumption theme. Covid has expedited the adoption curve of companies such as Zomato, India’s leading home delivery company. New habits are forming, which is something we as investors often underestimate. Valuations aren’t cheap, but for a certain portion of our portfolio as long as we like the opportunity and the management, we’re prepared to overlook valuations because the stocks will grow into them.

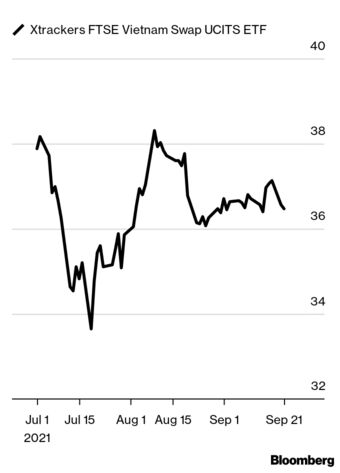

Vietnam is a similar story, but at one-third of the valuation, with long-term structural drivers of growth in urbanization picking up, income growth and great companies. We like Phu Nhuan Jewelry, the country’s leading mass-market jeweler. PNJ is gaining share from independent jewelers, which account for 70 to 80% of the market and also benefits from Vietnamese women starting to prefer diamonds over plain gold jewelry.

How to play it with ETFs: If your focus is Chinese tech platforms, the main players are Tencent and Alibaba, said Bloomberg Intelligence’s Sin. If you’d also like Meituan, it doesn’t get better than

Samsung CSI China Dragon Internet (2812 HK) , which has 45% of the portfolio in those three names. This ETF, with a 0.65% management fee, focuses on 30 of the largest global listed Chinese internet companies. To gain exposure to India, try

, which has 45% of the portfolio in those three names. This ETF, with a 0.65% management fee, focuses on 30 of the largest global listed Chinese internet companies. To gain exposure to India, try

iShares MSCI India (INDA US) , which has $6.4 billion in assets and a fee of 0.69%, or the

, which has $6.4 billion in assets and a fee of 0.69%, or the

UCITS version (NDIA LN) , which has a return of around 25% year to date, with almost 50% of assets in computers, diversified financial services, oil and gas, and banks. For Vietnam,

, which has a return of around 25% year to date, with almost 50% of assets in computers, diversified financial services, oil and gas, and banks. For Vietnam,

Xtracker FTSE Vietnam Swap UCITS (XFVT GR) , with $395 million in assets and a fee of 0.85%, has about 20% in consumer staples, and a year-to-date return of 30.3%.

, with $395 million in assets and a fee of 0.85%, has about 20% in consumer staples, and a year-to-date return of 30.3%.

Another way to play from Chadha: Art is close to my heart, particularly Vietnamese art. I’ve got pictures both in my office and my home. They’ve significantly increased in value since I bought them five or six years back, but when I see the prices of the art elsewhere, I think they are reasonable. One should go to a nice place like Apricot gallery in Ho Chi Minh City, Hanoi — it’s a big gallery with authenticated work. If I bought another painting I’d have money left over to buy a watch of my choice, which could be handed down, and I could still go on a nice holiday.