Hello. Today we look at how employment is recovering in much of the developed world, surging raw materials prices and China’s outlook.

Road to Recovery

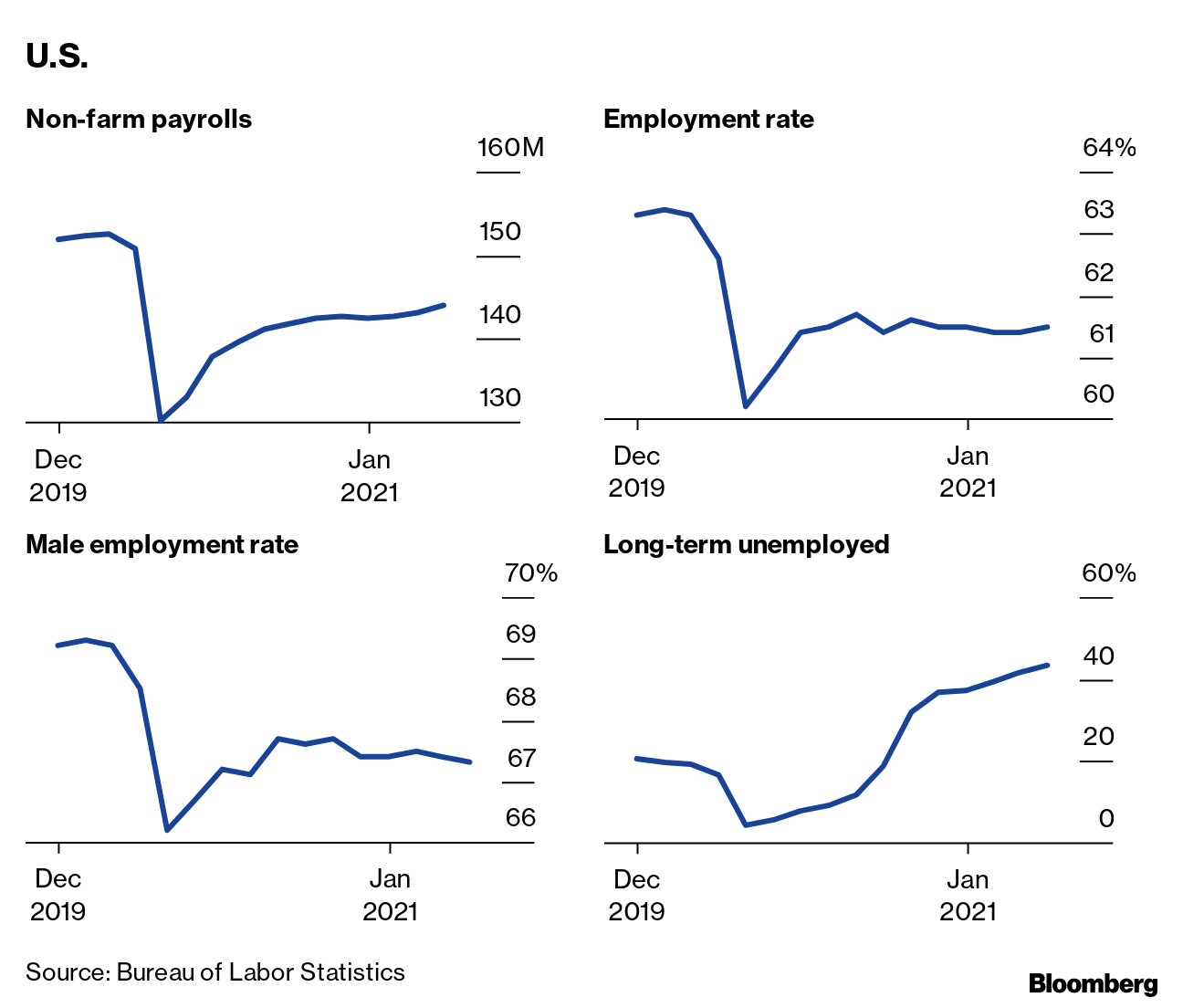

A look across the jobs scene across the developed world gives reason for optimism, and a warning against complacency.

First the optimism: American

payrolls data due Friday is forecast to show almost a million new positions secured in April after March numbers blew away economists’ expectations.

Europe’s rebound is slower, but headed in the right direction. Unemployment is also ticking lower again in Japan and South Korea’s steadier labor markets. Canada has recovered 90% of the positions lost from the coronavirus shock, while Australia has clawed all the way back to its pre-Covid total employment level.

U.S.

Source: Bureau of Labor Statistics

But as my colleague Enda Curran

writes, it’s too soon to declare mission accomplished.

At the aggregate level, even if the U.S. payrolls do meet bullish forecasts, the total will still be about 7 million shy of the pre-pandemic level.

While a year of unprecedented monetary and fiscal stimulus has kept many professionals in jobs, swatting away on keyboards from their kitchens, millions of lesser paid workers in the hospitality and tourism sectors also haven’t been so lucky. Many young, minority and women workers are languishing below their 2019 employment levels.

.

Just as cheap money is pushing up the value of rich people’s assets, the jobs recovery is shaping up as an uneven one too

That’s why global policy makers including President Joe Biden and Federal Reserve Chair Jerome Powell are keeping the stimulus spigot running, even as inflation pressures begin to rumble.

The Economic Scene

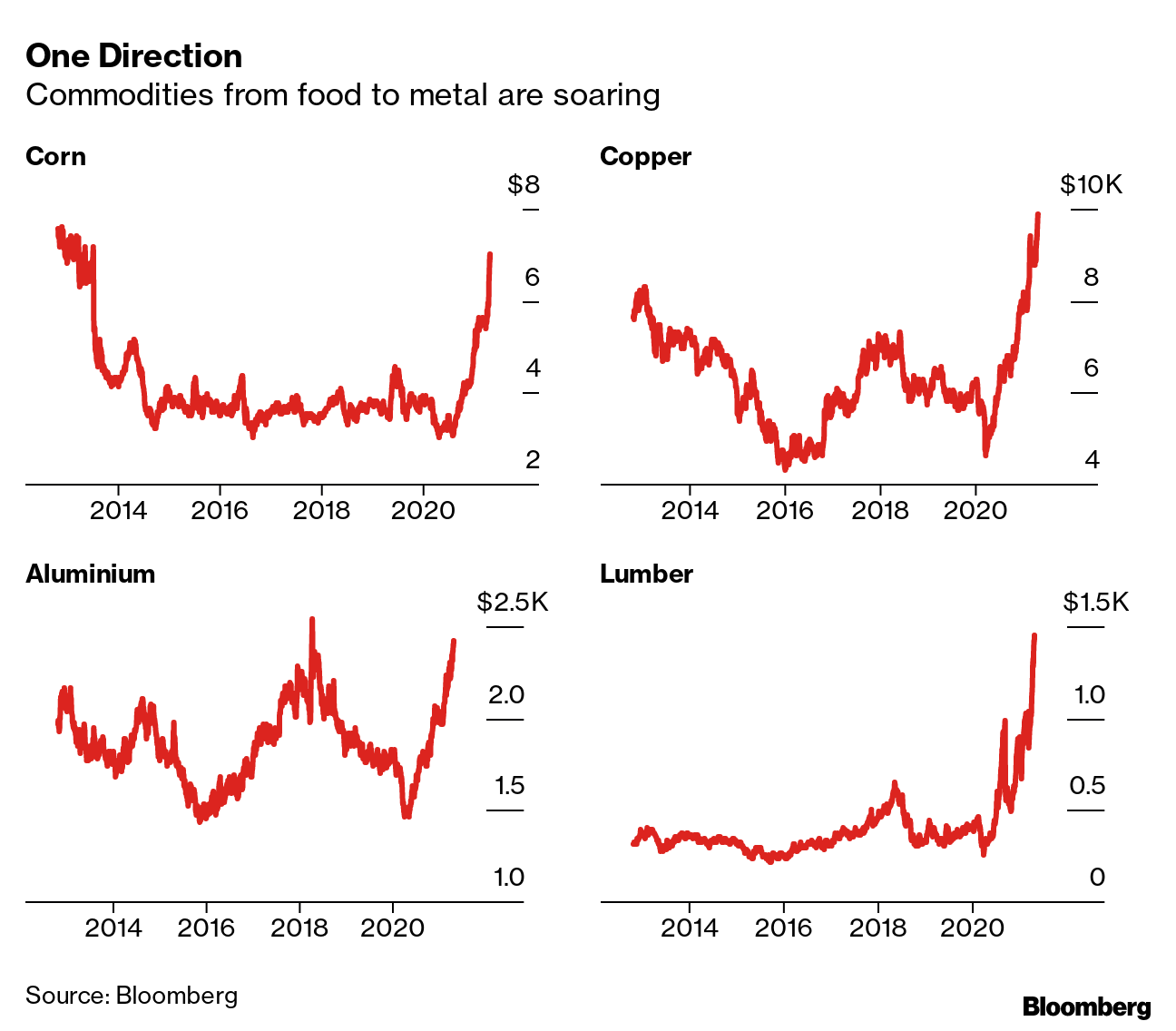

One Direction

Commodities from food to metal are soaring

Source: Bloomberg

The prices of raw materials used to make almost everything are skyrocketing, and the upward trajectory looks set to continue as the world economy roars back to life. In debate is what does that mean for inflation.

Today’s Must Reads

- U.S. inflation watch. Warren Buffett warned that the “red hot” U.S. economy combined with low interest rates is accelerating inflation. Still, Treasury Secretary Janet Yellen said Biden’s economic plan is unlikely to fan large price pressures in the U.S. because the boost to demand will be spread over a decade.

- Wealth tax battle lines. The top 1% of Americans took home 18.8% of pretax income last year. Biden’s drive to cut such inequality will focus on taxing the rich, backing unionized jobs, funding historically Black universities and extending health insurance tax credits.

- Sub-zero rates fallout. A battle is unfolding between Danish banks charging depositors to park their money and the government. That gives a sense of where the limits of negative rates may lie, and shows they might be political, not monetary.

- Developing world travails. India’s economic outlook is deteriorating by the day, and protests in Colombia that forced the president to shelve planned tax increases show the constraints on governments.

- Economic bellwether. South Korea’s exports last month rose the most in 10 years, reflecting a recovery in trade from the effects of the pandemic.

- The kids are not alright. British children are receiving less pocket money this year than last as parents tighten their belts through the crisis.

Need-to-Know Research

Did China under-estimate its economic expansion in the first quarter? We’ll probably never know for sure. But even

record high growth came in well below the pace implied by an aggregation of official monthly sectoral figures, according to Bloomberg Economics’ Chang Shu. Technical factors, such as differences in coverage, could account for some divergence, but the gap is unusually big — raising suspicions of data smoothing. Aggregation of industrial and services production puts first quarter growth at around 27.1% — 8.8 percentage points above the official 18.3%.

Lowballing China Growth

Gaps between official and Bloomberg Economics estimates of GDP growth

Source: NBS and Bloomberg Economics

Read the full research on the Bloomberg Terminal

On #EconTwitter

Variations of @xkcd’s “Types of Scientific Paper” have been making the rounds — we liked this one on trade policy.

Read more reactions on Twitter

Enjoy reading the New Economy Daily?

-

Click here for more economic stories

-

Tune into the Stephanomics podcast

-

Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter

- Follow us @economics