Less than two years into frenetic dealmaking that reeled in a haul from pharmaceuticals to agricultural trading, Mohamed Hassan Alsuwaidi’s biggest worry is if he’s moving “fast enough.”

The sense of urgency may seem surprising from the chief executive of

Abu Dhabi’s newest sovereign fund,

ADQ, which amassed an estimated $110 billion in assets since being founded in 2018, including a 45% stake in

Louis Dreyfus Company BV.

“We’ll deploy significant amounts this year and over the next five years,” Alsuwaidi, 38, said in a rare interview. “People will be amazed at how much we will be able to deploy in the markets we operate.”

Even in a city that’s among the few globally to manage around $1 trillion in sovereign wealth capital, ADQ has quickly emerged as Abu Dhabi’s go-to lever for addressing its biggest weaknesses.

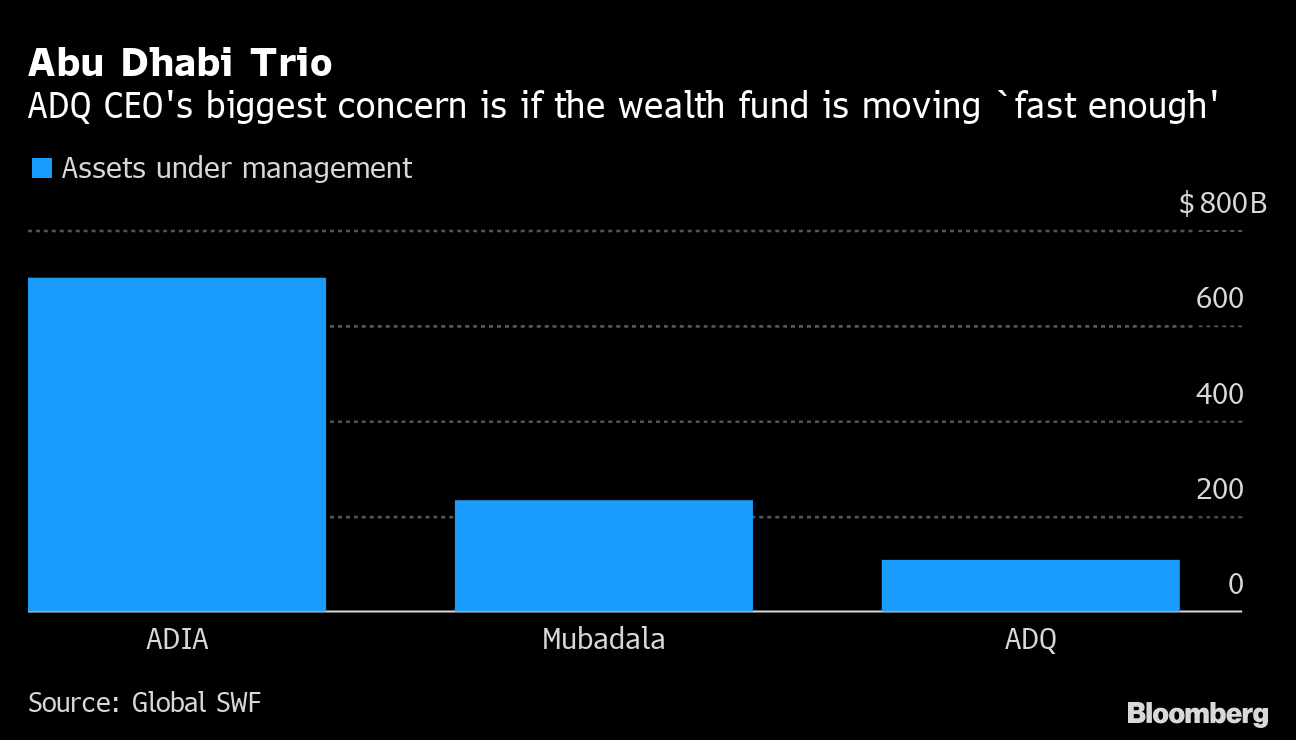

Although Alsuwaidi wouldn’t specify ADQ’s size, he said an estimate from Global SWF that put it at

$110 billion isn’t too far off. Moreover, that number should double within seven to 10 years, he said. ADQ currently has 120 employees, of which 60 to 70 are directly involved in the fund’s investments.

Abu Dhabi Trio

ADQ CEO’s biggest concern is if the wealth fund is moving `fast enough’

Source: Global SWF

ADQ is among an emerging breed of state funds in the Gulf region that are increasingly having to reconcile their ambitions as global investors with the priorities of domestic economies.

Originally known as

Abu Dhabi Developmental Holding Co., the entity took custody of some of the emirate’s biggest assets, from air and sea ports, the stock market operator and the nuclear energy corporation to health care and utilities.

The abbreviation of the company’s name proved a mouthful and was soon abandoned in favor of ADQ, according to Alsuwaidi. Its mission: to “extract value” out of the state assets through whatever means available, he said.

Alsuwaidi, a former executive at a larger Abu Dhabi state fund,

Mubadala Investment Co., says he’s constantly on the lookout for ways to deliver on its goal by listing, merging or selling assets.

“Every single asset, every day of my life, will continue to be on the list to be taken public or monetized,” he said. “And that will happen day in, day out.”

Chaired by a royal family member, Sheikh Tahnoon Bin Zayed Al Nahyan, ADQ has quickly joined the ranks of the world’s top 20 sovereign funds and is now the UAE capital’s third-largest after

Abu Dhabi Investment Authority and Mubadala. Deal-hungry bankers privately describe the vibe around it as a “gold rush.”

The fund’s domestic focus — 90% of its portfolio consists of Abu Dhabi assets — still distinguishes it from its bigger counterparts. ADIA’s mandate as a rainy-day fund is to funnel the government’s oil surplus into foreign holdings, while Mubadala combines investments abroad and at home.

“We will always be more Abu Dhabi-weighted versus any of our peers,” Alsuwaidi said.

“We do have characteristics of a sovereign fund,” he said. “But we are defined in our articles as a holding company with developmental nature. And so, core to our bread and butter, is that developmental nature of our investments and our deals.”

Wider Reach

But it was ADQ’s investment in Louis Dreyfus that catapulted it to global prominence for the first time last year. Another focus is Egypt, where ADQ has committed to investing $10 billion alongside the country’s sovereign fund. It also recently bought an Egyptian pharmaceuticals company from

Bausch Health Cos., while also investing in a UAE supermarket chain expanding in the North African country.

Despite the acquisitive streak, the major preoccupation remains ADQ’s role back home.

“To maximize any investment, sometimes you need to create an international tie-up,” Alsuwaidi said. “Sometimes a global presence with an Abu Dhabi anchor is the way to extract more value for the shareholder.”

Concerns about over-dependence on others to ensure vital supplies of food and medicine and the speed with which global supply lines were disrupted during the pandemic now appear to drive the fund’s philosophy. Four sectors in particular have caught ADQ’s attention and they’re all vital to the emirate’s long-term future: energy and utilities, food and agriculture, mobility and logistics, as well as health care and pharma.

Energy accounts for 65% of ADQ’s portfolio and its share is likely to remain roughly the same even as it becomes part of a “greater pie,” Alsuwaidi said.

“We shouldn’t shy away from the fact that we’re oil long position,” Alsuwaidi said.