Norway is trying to make its dirtiest industry as clean as possible. The multi-billion-dollar plan will do little to reduce the nation’s overall climate impact.

The Nordic country will use land-based green hydropower to electrify dozens of offshore oil and gas platforms. That will help meet national climate targets, and so allow the lucrative industry to keep pumping fossil fuels for decades more.

Explore dynamic updates of the earth’s key data points

But most of the emissions from oil and gas come when it’s burned — not when it’s extracted — so the initiative will do little to rein in pollution globally.

The move, which is mostly funded by the taxpayer, shines a light on how some countries and companies are finding ways to meet their own climate goals without jeopardizing their economic interests — and without benefiting the planet much either. Norwegians may buy more electric vehicles than conventional cars, but the country is a massive exporter of carbon.

“The oil industry is the biggest polluting sector, so if you want to cut emissions in Norway to meet the climate targets you will not get far without electrifying it,” said Kjetil Lund, head of the Norwegian Water Resources and Energy Directorate, which regulates the energy supply.

Norway’s oil and gas industry released 14 million tons of greenhouse gases from its facilities in 2019, according to Statistics Norway. That’s almost 28% of the country’s total, making the sector an obvious target in the nation’s quest to reduce its emissions by 40% by 2030.

It’s also something that’s costing oil and gas companies money right now. The cost of permits in Europe’s emissions trading program, which includes Norway’s oil and gas platforms, have surged more than 50% this year to a record, and analysts are forecasting big gains ahead. In addition, Norway plans to punish emitters further with a national tax.

Equinor won’t reach an intermediate target to cut its emissions by 40% by 2030 without connecting platforms to the power grid, said Henriette Undrum, senior vice president for the company’s New Energy Solutions arm. The choice is between electrification and curbing oil and gas output substantially.

“I think it makes sense for the Norwegian authorities to use Norwegian power as an important tool to secure long-term income and jobs,” Undrum said.

Exporting Carbon

Direct emissions from Norway’s oil and gas facilities are just a fraction of the sector’s true climate impact. The fossil fuels exported from Norway last year would emit about 450 million tons of carbon dioxide if burned, nine times the nation’s total emissions in 2019, according to Bloomberg calculations based on Ministry of Petroleum and Energy data.

Those emissions would be untouched by the electrification plan, so cleaning up at home would in fact be allowing the industry to keep exporting billions of tons of carbon dioxide over the coming decades.

“Even if most of the emissions come from consumption, we still have to cut emissions from production,” said Stig Schjolset, adviser with the Oslo based environmental organization Zero.

There will be substantial Norwegian oil and gas production from existing fields for the next 10 to 15 years, so even if exploration were to stop today the industry would still be going in 2030, when the national target of a 40% emissions reduction must be achieved, Schjolset said. So electrification of the industry is an example of “how we want climate policy to work.”

Equinor electrification plans in the North Sea

Some of the largest oil and gas producers in Norway have come up with separate plans for addressing the carbon generated from burning the products they sell, so-called Scope 3 emissions.

Equinor ASA, Norway’s biggest producer, has set a target of achieving net-zero emissions by 2050, including carbon dioxide produced from the final consumption of the oil and gas it sells.

Royal Dutch Shell Plc, another large operator in the country, has set a similar goal. Both plans rely on using existing oil and gas infrastructure to capture emissions and store them underground, back in the North Sea wells where they came from.

“If you think that you can re-purpose an asset for carbon storage you can add another 15-20 years of life-span,” said Pierre Girard, director of new energy at Neptune Energy Ltd., an independent explorer that’s also studying the concept. “You introduce a much longer time horizon to justify electrification.”

Equinor’s Johan Sverdrup field is fully electrified.

Photographer: Carina Johansen/Bloomberg

Equinor’s Johan Sverdrup oil field is already fully electrified. It started production two years ago and is expected to operate for more than 50 years. The process of extracting the oil emits 0.67 kilograms (1.5 pounds) of carbon dioxide per barrel, compared with the company average of 9 kilograms. The global average is 18 to 19 kilograms.

So far, eight fields and offshore facilities, less than 10% of the total, have been connected to the grid. The cables run along the seabed to platforms as far as 300 kilometers (186 miles) from the shore.

Last month, Equinor announced plans to electrify the giant Troll B and C platforms, which will cost 7.9 billion Norwegian kroner ($950 million). The B facility would be partially electrified in 2024, and the latter fully from 2026, according to documents submitted to the Government.

The plans are facing increasing scrutiny ahead of Norway’s general election in September. The country wants to use more electricity to clean up industrial processes and transport, while also building new power-hungry enterprises such as data centers and battery makers.

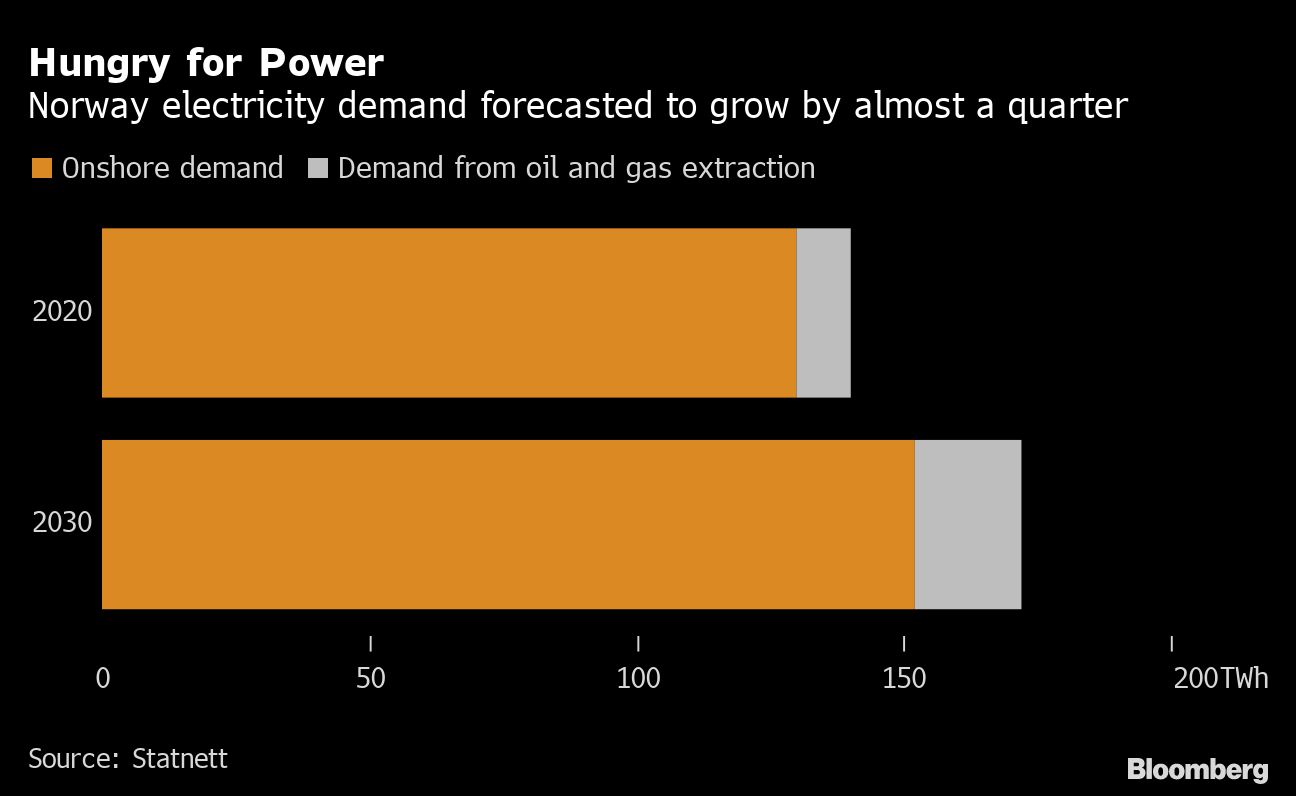

Hungry for Power

Norway electricity demand forecasted to grow by almost a quarter

Source: Statnett

These extra demands are coming at a time when the nation is starting to

turn away from onshore wind power, and grid manager Statnett SF is forecasting that a traditional power surplus will evaporate. The Labor Party, which looks likely to lead a coalition after the election, backs the power expansion but would prefer if it came from floating wind parks, a technology still in its infancy.

“We want more electrification, bigger emission cuts, new green industry, no more wind power,” said Lund. “But we cannot have it all at the same time.”

— With assistance by Elena Mazneva