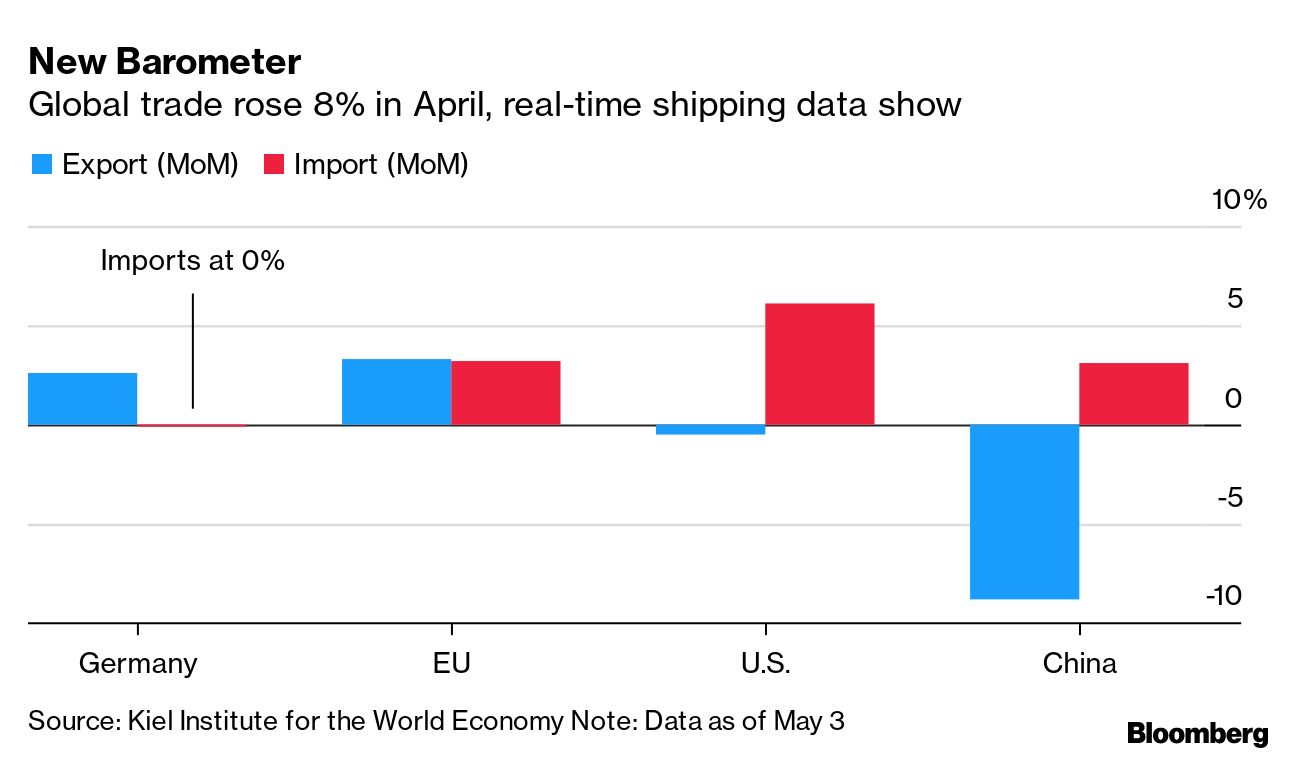

Chinese and U.S. exports slumped last month while the European Union’s rose, according to a new measure for global trade by developed by German researchers.

The Kiel Institute for the World Economy’s gauge is the latest in a string indexes that aim to track more closely the pandemic-induced shipping snarls and

container logjams that have stymied goods trade along busy routes like Shanghai to Los Angeles.

“In the pandemic we’ve seen very clearly that it’s extremely important to figure out early what’s happening,” said Gabriel Felbermayr, president of the organization. “Disruptions are increasing. It’s something we need to prepare for,” with climate change causing more extreme weather and political risk also rising, he said.

The April drop of 8.8% in Chinese exports is the first month-on-month decline in nearly a year, the Kiel data showed. Germany’s exports have posted an increase each month over the past year, following a deep dive when the pandemic first hit.

The twice-monthly German measure uses artificial intelligence to analyze activity in 500 ports and 100 maritime regions around the world in real time.

New Barometer

Global trade rose 8% in April, real-time shipping data show

Source: Kiel Institute for the World Economy

Note: Data as of May 3

“This is the first time in a year that container ship movements have shown a departure from China’s robust export growth,” Kiel project head Vincent Stamer said.

While the recent

Suez canal fiasco may be a factor, it also may be “that thanks to improving vaccination rates, demand among consumers in Europe and the U.S. is shifting away from Chinese consumer goods toward domestic services such as restaurant visits.”

Kiel’s initiative comes as others are trying to keep closer tabs on international trade flows at key chokepoints like ports. In partnership with the World Bank, IHS Markit launched the Container Port Performance Index designed to identify opportunities for improvement in container port operations.

—Catherine Bosley in Zurich

Save the Date

The fourth annual Bloomberg New Economy Forum will convene the world’s most influential leaders in Singapore this November 16-19, 2021 to mobilize behind the effort to build a sustainable and inclusive global economy. Learn more here.

Charted Territory

Chip plants run 24 hours a day, seven days a week. They do that for one reason: cost. Building an entry-level factory that produces 50,000 wafers per month costs about $15 billion. Most of this is spent on specialized equipment — a market that exceeded $60 billion in sales for the first time in 2020. Three companies — Intel, Samsung and TSMC — account for most of this investment. Their factories are more advanced and cost over $20 billion each. This year, TSMC will spend as much as $28 billion on new plants and equipment. Compare that to the U.S. government’s attempt to pass a bill supporting domestic chip production. This legislation would offer just $50 billion over five years.

Today’s Must Reads

- Support to share | The U.S. will support a proposal to waive intellectual-property protections for Covid-19 vaccines, joining an effort to increase global supply and access to the life-saving shots as the gap between rich and poor nations widens. Meanwhile, drugmakers in India are warning that a halt on some cargo flights from China could imperil an important link in the global pharmaceutical supply chain.

- Beetle juice | Volkswagen raised its earnings outlook after a strong start to the year, while cautioning that the semiconductor shortage rippling through the industry will become more pronounced in the second quarter. Yet, General Motors left its full-year outlook unchanged and said that, if anything, it would hit the higher end of its 2021 earnings target.

- Save the crews | Unilever and other big retail brands are among consumer giants adopting a toolkit to audit their shipping supply chains in an effort to help bring seafarers stuck on commercial vessels back home and eliminate human-rights risks.

- China tensions | China announced that it was suspending a ministerial economic dialogue with Australia, in a largely symbolic move showing Beijing’s growing frustration with Canberra. Separately, China urged Western nations to stay out of its affairs and fix their own problems.

- Pig problem | A bipartisan group of U.S. House lawmakers is asking the Biden administration to seek the elimination of Vietnam’s tariffs on American pork and address other restrictions as it engages with the Southeast Asian country over currency and trade practices.

- Storage full | Finding warehouse space around Toronto has never been harder, and the e-commerce-fueled shortage is disrupting businesses and threatening the broader economy.

- Jersey shore | The U.K. and French navies dispatched military patrol vessels to the isle of Jersey amid a deepening row over post-Brexit fishing rights.

- Stephanomics podcast | Amazon, Apple, Facebook, Microsoft and Google together make more money in a week than McDonald’s now makes in an entire year. Host Stephanie Flanders talks with Bloomberg’s Chief Economist Tom Orlik about what the rise of these mega-companies could mean for the global economy.

On the Bloomberg Terminal

- Taking trains | Bullish rate commentary from truckload carriers on first-quarter earnings calls suggests a favorable backdrop for rail transport to win share from highway in 2021, Bloomberg Intelligence writes.

- Set to deliver | Strong profitability in Deutsche Post’s forwarding business should remain supported by yield tailwinds from ocean and air-capacity challenges, Bloomberg Intelligence writes.

- Use the AHOY function to track global commodities trade flows.

- Click HERE for automated stories about supply chains.

- See BNEF for BloombergNEF’s analysis of clean energy, advanced transport, digital industry, innovative materials, and commodities.

- Click VRUS on the terminal for news and data on the coronavirus and here for maps and charts.

Like Supply Lines?

Don’t keep it to yourself. Colleagues and friends can sign up here. We also publish Balance of Power, a daily briefing on the latest in global politics.

For even more: Follow @economics on Twitter and subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and gain expert analysis from exclusive subscriber-only newsletters.

How are we doing? We want to hear what you think about this newsletter. Let our trade tsar know.