While the planet’s supply-chain

issues have roiled industries and hit consumers with higher costs, the convulsions have also presented an opportunity for generous profits for some investors.

Mangrove Partners in New York bought four Panamax container ships for a total of $32 million in 2017, according to transaction data from VesselsValue. A year ago, those had a value of $34.1 million. Perhaps auspiciously so, the firm renamed all four ships for the veteran coach and then-players of the New England Patriots.

On Sept. 1, MP The Brady (named for Tom Brady, who spent two decades as Patriots quarterback), MP The Gronk (after tight end Rob Gronkowski), MP The Edelman (for wide receiver Julian Edelman), and MP The Belichick (for coach Bill Belichick) were sold en bloc to Mediterranean Shipping Company for $242 million, according to VesselsValue.

Four Patriots-named container ships

Mangrove’s investment fetched nearly seven times its total purchase value: a head-spinning $210 million. FreightWaves reported the transaction last week. MSC and Mangrove declined to comment.

According to Bloomberg’s mapping function, The Brady is currently tied up in Turkey, The Edelman is running a route toward Portugal and The Belichick is stationary near Seattle. After a journey from Australia, The Gronk is moored near Hong Kong.

Container-shipping rates have set

record levels this year as the demand for goods stays solid in the ongoing economic recovery. That’s resulted in record demand for ships, according to Felix Mathes, a cargo analyst at VesselsValue.

In the secondhand market, the number of sales so far this year has more than doubled compared with the same time in 2020, with $7.3 billion spent, he said.

Other statistics Mathes shared on

the chase for deck space:

- MSC “has been on a buying spree,” purchasing more than 100 used vessels and favoring the smaller Panamax and sub-Panamax varieties.

- In the market for new capacity, orders for a record 3.8 million 20-foot equivalent units, or TEUs, have been placed since the start of the year. This equates to a total of 410 vessels, and compares with just 43 ordered through the same time in 2020 and 68 a year earlier.

- About $32 billion has been spent on container orders this year alone with Seaspan at the forefront of this growth.

- The order book stands at 12.6% of the fleet, the highest since the last peak around 2008. This is likely to ease markets significantly in 2023-2024, when the majority of the new tonnage is delivered and supply and demand will eventually balance out, he said.

With freight rates rising to record levels, “it is cheaper for the big liner companies to buy vessels than to charter them,” Mathes explained.

The four “New England Patriots” Panamax vessels are today worth $296 million compared with the $242 million MSC paid at the start of the month, he said.

Prices are only likely to start

plateauing in 2022 as supply disruptions and container availability resolves, although a low number of new-build deliveries, especially in the first half of the year, will provide support to the market, Mathes said.

—Jill R. Shah in New York

Charted Territory

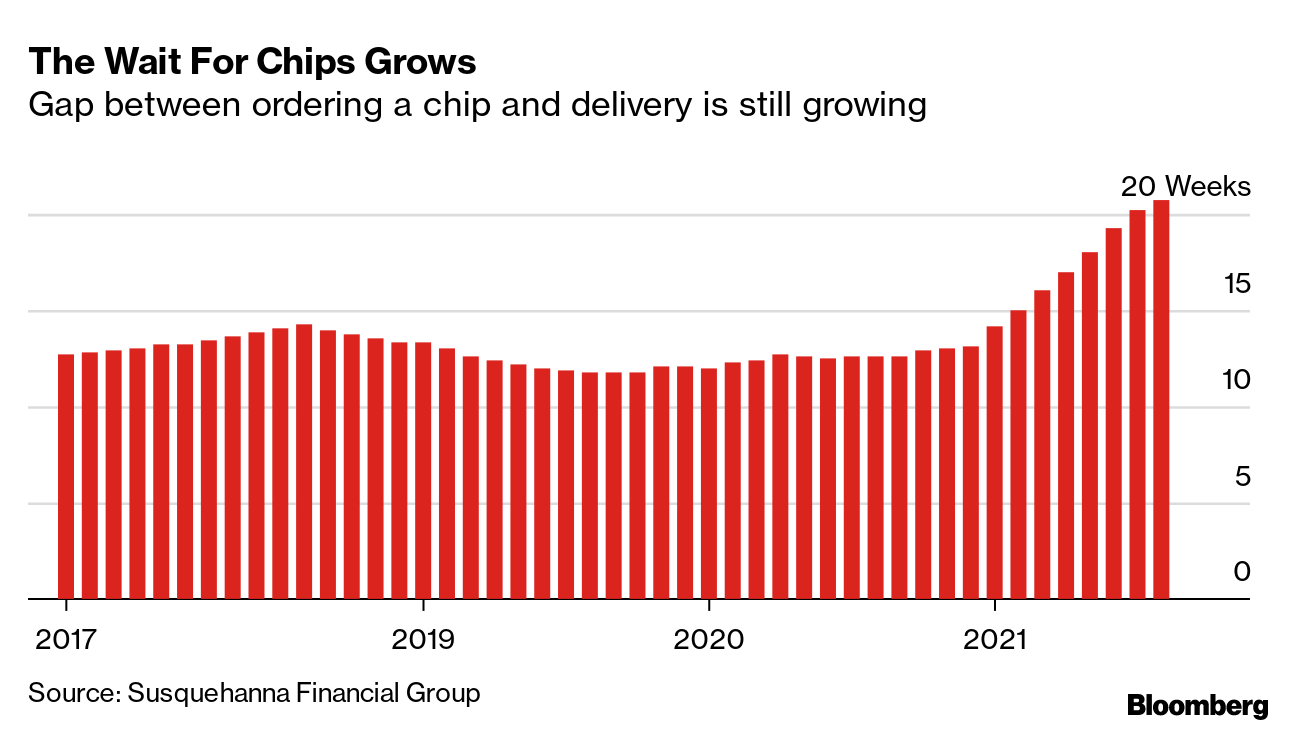

The Wait For Chips Grows

Gap between ordering a chip and delivery is still growing

Source: Susquehanna Financial Group

The amount of time it’s taking for chip-starved companies to get orders filled stretched to 21 weeks in August, indicating the shortages that have crippled auto production and held back growth in the electronics industry are

getting worse. Chip lead times, the gap between ordering a semiconductor and taking delivery, increased by 6 days to about 21 weeks in August from the previous month, according to research by Susquehanna Financial Group. Volkswagen’s truck division Traton SE became the latest manufacturer to

warn the global shortage of semiconductors has jeopardized deliveries.

Today’s Must Reads

- Transatlantic ties | The U.K. is exploring joining an existing free-trade agreement between the U.S., Mexico and Canada, a recognition that the Biden administration is refusing to start negotiations on a bilateral deal any time soon. Separately, Britain’s government is supporting an effort by CF Industries to restart fertilizer production in a bid to ease a shortage of carbon dioxide that’s crucial for the food industry.

- Membership grows | Taiwan has submitted an application to join a Pacific trade deal, just days after China sent its own request to become a member of the agreement which was once pushed by the U.S. as a way to isolate Beijing and solidify American dominance in the region.

- Danish history | Maersk is now heading for a full-year profit that will match its combined results from the past nine years and make business history in its home country Denmark.

- Potential delay | France’s bid to delay a pivotal European Union trade meeting with the U.S. gained support from the Netherlands and other member states as they assess a new defense pact Washington struck with Australia and the U.K. Meanwhile, a draft statement ahead of that meeting shows the U.S. and EU are cautiously moving to rein in China, seeking stronger enforcement of investment-screening rules and trying to keep technology from being misused to threaten security and human rights.

- Protection promised | Two nominees for key trade-policy positions in the U.S. Commerce Department pledged to use their roles to prevent the transfer of sensitive technologies to China and adversarial nations, if appointed.

- Robot revolution | At Amazon’s flagship fulfillment center outside Seattle, the retailer uses algorithms and robots to ship more than a million packages a day — vastly changing the jobs of humans in the process.

On the Bloomberg Terminal

- Chemical outlook | Growth in U.S. chemical demand remains on a strong footing, though shortages of some materials among manufacturing customers raise concerns, according to Bloomberg Intelligence.

-

Heavy traffic | Freight-market dislocations created by equipment shortages, port disruptions and limited driver availability are weighing on truck tonnage, according to Bloomberg Intelligence. Supply constraints narrowed large carrier fleet sizes by about 7% in 2021 through July.

- Use the AHOY function to track global commodities trade flows.

- Click HERE for automated stories about supply chains.

- See BNEF for BloombergNEF’s analysis of clean energy, advanced transport, digital industry, innovative materials, and commodities.

- Click VRUS on the terminal for news and data on the coronavirus and here for maps and charts.

Like Supply Lines?

Don’t keep it to yourself. Colleagues and friends can sign up here. We also publish the New Economy Daily, a briefing on the latest in global economics.

For even more: Follow @economics on Twitter and subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and gain expert analysis from exclusive subscriber-only newsletters.

How are we doing? We want to hear what you think about this newsletter. Let our trade tsar know.

— With assistance by Bryce Baschuk